Lumber price forecast lumber lb price prediction.

Timber hardwood price projections.

Southeastern average stumpage prices us ton.

22 74 24 56 1 82 29 41 6 67 mixed hardwood sawtimber.

The tms market news bulletin 2q2020 see also sample summary report and state.

If mills need wood prices go up.

If mills don t need wood prices go down.

Different markets have different characteristics that make them.

Timber prices are directly affected by the forces of supply and demand.

However there are several other factors that influence the price of timber by region.

However there are several other factors that influence the price of timber by region.

If mills don t need wood prices go down.

Mills mills are the foundation of established timber markets because they determine what products can be.

The best long term short term lumber price prognosis for 2020 2021 2022 2023 2024 2025 with daily lumber.

Forest2market s timber price database contains 20 years worth of transaction level details from more than 6 billion in timber sales.

2q20 2q19 up dn 2q10 up dn pine sawtimber.

Global softwood demand in 2020 is forecast to show an increase of around 2 2 2 5 per cent as compared to 2019.

Timber prices are directly affected by the forces of supply and demand.

Timber prices a regional review and forecast of north american timber prices including delivered and stumpage prices for softwood sawtimber pulpwood and chips.

Mills mills are the foundation of established timber markets because they determine what products can be.

If mills need wood prices go up.

Lumber prices have been hovering around 600 per 1000 board feet in the second part of september entering into correction territory after reaching an all time high of almost 1000 on september 14th.

The outlook for 2021 calls for a more optimistic expansion with global demand expanding by up to 2 7 per cent.

30 65 30 82 0 17 23 43 7 22 source.

This transactional data provides a full spectrum view of market dynamics and includes detailed information supplied by forest products companies wood dealers loggers consultants and landowners.

The analysis of timber supplies and wood demand matches the location of wood sources to forest industry manufacturers.

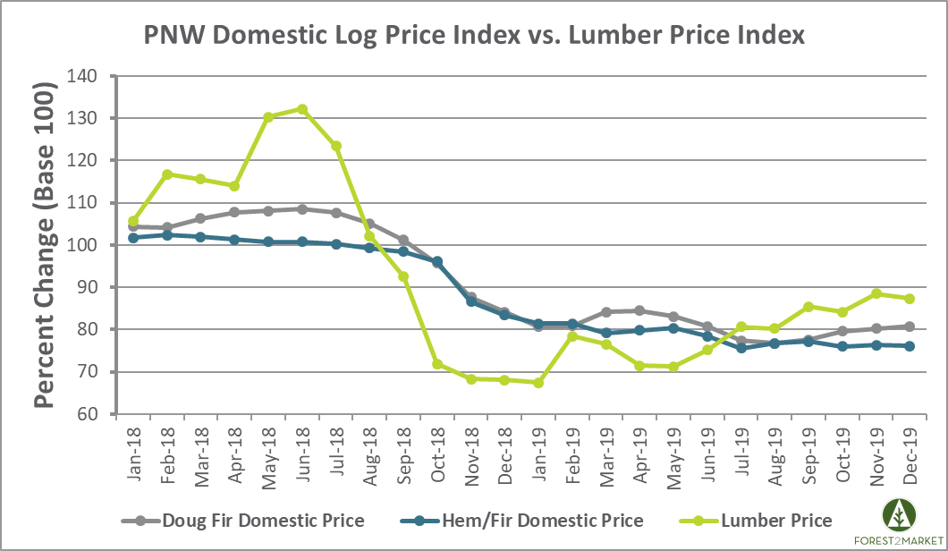

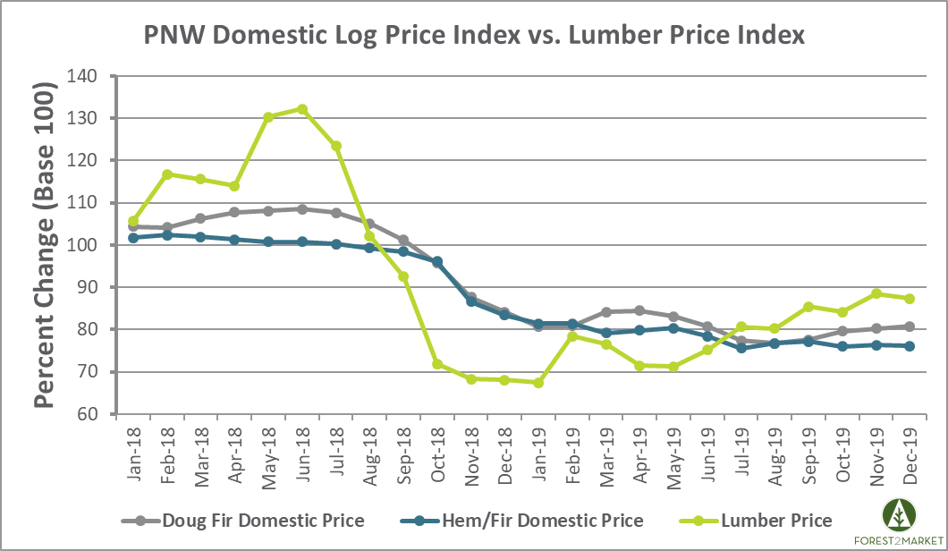

Our 2019 pine grade projections suggest that the pendulum may be poised to swing back in the near future figure 1.

The demand from the renovation and new home markets and low interest rates are behind the recent rise as americans are on the quest to move away from the cities and improve their houses in a wake.

The graph below shows the annual change in grade inventory for the u s.

Why fastmarkets risi more than 80 of the world s leading forest products companies plus buyers distributors suppliers governments and financial analysts rely on.